At Litso Travels, we always ensure to maintain the security and privacy of our trusted travelers and this is why, we only work with top travel insurance provider in Pakistan. With a few clicks, you can get the right travel insurance with all necessary coverage yet at an amazing discounted price. We ensure you can get maximum benefit and safety on your upcoming travel plans. With our team of expertise, collaborations with top travel insurance companies, and 24/7 available customer support, you can rest assured of convenience and reliability.

Get High Discount on Travel Insurances

Where a Travel Insurance Can Save You

- Losing Passport or other documents

- Trip cancellation due to any reason

- Delayed departure and other flight issues

- Emergency return to home

Contact Us

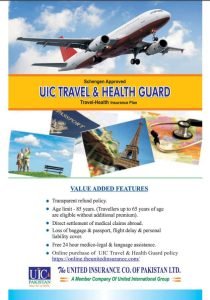

Travel insurance provides medical and financial assistance during traveling. Before starting a trip make sure that traveler must be properly and securely covered for any emergency aid. There are many travel insurance companies in Pakistan for providing these services. The United Insurance Company of Pakistan Limited provides its client with the best. The UIC is rated AA by PACRA.

Buy Travel Insurance Online:

Clients comfort is our first priority. The UIC initiated the hassle free provision of buy travel insurance online that can be acquired at anytime from anywhere.

Let “AA+“ rated national insurer provide you:

- Maximum coverage in lesser price.

- Services without any hidden charges & taxes etc.

- Support of European companies for Re-insurance & Assistance Services.

- Transparent premium refund policy.

- Service at your doorstep with nation wide network of 100+ branches.

- Transparent refund policy.

- Age Limit – 85 years. (Travelers up to 65 years of age are eligible without additional premium).

- Direct settlement of medical claims abroad.

- Loss of baggage & passport, Flight delay & personal liability cover.

- Free 24 hour medico-legal & language assistance.

- Pre-Existing medical conditions.

- War, Invasion/terrorism.

- Fire Penalties/ punitive damages.

- For more detail on exclusions refer to policy wording.

- Post-Treatment Screening/Test taken in abroad is only covered when /if resulted Positive.

- Self-quarantine/ quarantine in Private Hotels or Hospitals or at home is not covered under the said policy terms & condition.

- U.S $100 deductible on loss arising from COVID-19.

- Follow-up treatment is only covered when/if a followed up test is Positive and prescribed by a medical practitioner of recognized hospital.

- In Case the Insured Person tested positive with COVID-19 during a trip covered, the Insurance Cover only medical Expenses & Hospitalization Abroad.

- All claims related to COVID-19 will only be considered after the submission of Negative test report undertaken within 96 hours before travel.

- All claims related to COVID-19 will be settled on Re-imbursement basis in PKR only.

- Maximum Insured’s age 70 years to obtain COVID-19 Coverage.

Frequently asked questions

A travel insurance is more like a protective shield on your trips that saves you from unforeseen events that may happen during travel. For example, loosing documents, encountering medical emergencies, loosing luggage, dealing with delayed departure, etc. The first thing that saves you on your trip in case of any mishap is indeed your travel insurance.

You should always try to save money but it should not cut the cost on the efficacy of the service. Though you need to save every penny when vacationing, getting a travel insurance can save you a lot. To save on the prices of travel insurance, you can explore the site or can contact our customer service center to discuss the elements of your tour to get the best sufficient yet affordable travel insurance.

Well, probably the easiest way is to pay for the travel insurance is paying online using your master, credit, or debit card. But if you are not comfortable with making an online transaction, you can connect with us to transfer the amount via easypaisa, JazzCash, bank transfer, or an other convenient mode of transaction. You can opt for COD (Cash on Delivery), too. At Litso, your convenience comes first!

You need to take your insurance paper with you on your trip and you’ll need the policy number mentioned on your policy along with contact details to claim your insurance abroad. Usually, insurances are provided with 24/7 assistance services to catch any emergency on the moment. If there’s a need to claim your insurance, simply contact your insurance provider and provide the relevant details of the mishap or the incident. Once you receive the claim form, download it, and wait for the claim amount as per the plan. Usually, there is a deadline of around 31 days, it is always suggested to act as promptly as possible.

Adding on, if you face a medical emergency on your trip abroad, you would have to ask for an authorization to proceed from your insurer. In case of theft or crime, you must contact the police within 24hrs of the incident to be at the safe side. Where this may help you find the thief, the police report is crucially required by the insurer for the persuasion of the claim. Adding on, if you lose any of your personal belongings, you might also be required to provide the proof of the ownership like a receipt etc.

The insurance policy pays a certain amount in response to the claim and also extrudes some of the events like getting injured while drunk or playing hazardous sports. This is why you need to have a detailed look into your insurance at the time of the order.

The process of buying travel insurance is the easiest on the platform of Litso Travels – just tap through some of the entries asked at the top of the page. For example, your traveling dates, number of persons, cost of the trip, and destination and simple get the quote. Here, you can search through various options available to find which one suits you the best or you can simply contact the customer support to get information.

Once selected, proceed by opting for a payment method as per your convenience and once the payment is successful, you can receive your travel insurance ready to be downloaded in your

phone.

Once the payment is successful, it usually takes a few minutes to send you the email you’re your insurance. But in some cases, it might take up to 60 minutes or above depending on the circumstances. For convenience and tracking, you can always contact Litso’s customer support team.

You can extend your travel insurance policy under certain circumstances but on pre-defined requirements and conditions. The first requirement is, the issued policy should not have been claimed till date. Other requirements vary depending on the insurance policy, insurer policy, terms & conditions and other factors. In general, you can always ask for an extension if you yet have not made a claim on your insurance policy.